So, you’re thinking about signing a long-term apartment lease? That’s a big decision! Before you commit to a year or more in a new place, there are some crucial things you need to know. This guide covers essential factors to consider, from understanding your lease agreement to calculating hidden costs and avoiding potential rental scams. Don’t sign that lease until you’ve read this – your future self (and your wallet) will thank you! Let’s dive into the must-know information for securing a great long-term rental.

Introduction: The Commitment of Long-Term Leasing

Signing a long-term apartment lease is a significant commitment. Unlike short-term rentals, you’re agreeing to live in the same apartment for an extended period, typically a year or more. This means you’ll be financially and logistically tied to that specific location for the duration of the lease.

Before signing, carefully consider the implications. This includes not only the financial aspect of consistent rent payments, but also the potential limitations on your flexibility. Job changes, unexpected life events, or a simple desire for a different living environment could be significantly impacted by a long-term lease. Understanding the full extent of your commitment is crucial to making an informed decision.

The benefits of long-term leases can include lower monthly rent compared to short-term options and greater stability. However, these advantages must be weighed against the potential drawbacks of reduced flexibility. Ultimately, the decision of whether or not to sign a long-term lease hinges on your personal circumstances, financial stability, and long-term plans.

Understanding Lease Terms and Conditions

Before signing a long-term apartment lease, carefully review all terms and conditions. This is crucial to avoid future misunderstandings and potential legal issues.

Pay close attention to the lease length. Understand exactly how long you’re committing to the rental agreement. Note any early termination clauses and the associated penalties.

Scrutinize the rent amount and the payment schedule. Confirm the method of payment and any late fee policies. Also, understand how rent increases are handled during the lease term.

Utilities are a significant expense. Clearly define which utilities are included in the rent and which ones are the tenant’s responsibility. Likewise, understand any rules regarding guests and pets.

Review the maintenance and repair responsibilities outlined in the lease. Understand who is responsible for addressing different types of repairs and maintenance issues, as well as the process for submitting requests.

Familiarize yourself with the lease renewal process. Understand how and when the lease can be renewed, as well as any associated terms or conditions.

Finally, don’t hesitate to ask questions. If anything is unclear or confusing, seek clarification from the landlord or property manager before signing. It’s better to understand everything upfront than to face unforeseen problems later.

How to Negotiate Favorable Lease Terms

Negotiating lease terms can seem daunting, but a little preparation can go a long way. Before you sign anything, understand that flexibility is key. Landlords are often willing to compromise, especially if they’re trying to fill a unit quickly.

Start by researching comparable rentals in the area. This gives you a benchmark for rent prices and included amenities. Armed with this information, you can confidently discuss the listed rent price.

Don’t be afraid to ask questions. Inquire about lease terms like lease length, pet fees (if applicable), and renewal options. If something isn’t explicitly stated, ask for clarification.

Consider proposing a longer lease term in exchange for a lower monthly rent. This reduces risk for the landlord, potentially making them more amenable to negotiation.

Be polite and professional throughout the process. A respectful approach can significantly improve your chances of reaching a favorable agreement. Remember, negotiation is a two-way street; be prepared to compromise.

Finally, always read the lease carefully before signing. Understand every clause and don’t hesitate to ask for clarification on anything you don’t understand. A thorough review protects your interests.

Checking for Maintenance Responsibilities

Before signing a long-term apartment lease, carefully review the lease agreement regarding maintenance responsibilities. This is crucial to avoid unexpected costs and frustrations later.

Understand what repairs and maintenance are the landlord’s responsibility. This typically includes major repairs like plumbing issues, HVAC system malfunctions, and structural damage. The lease should clearly define these responsibilities.

Conversely, identify your tenant responsibilities. This often includes minor repairs like unclogging drains, changing light bulbs, and keeping the apartment clean. A clear understanding of these will prevent disputes.

Clarify the process for reporting maintenance issues. Find out how to submit requests, the timeframe for responses, and what happens if repairs are not completed promptly. Consider asking about their emergency maintenance policy.

Don’t hesitate to ask questions if anything is unclear. It’s better to have a thorough understanding before committing to a long-term lease. A clear understanding of maintenance responsibilities can save you money and headaches during your tenancy.

The Importance of Reading the Fine Print

Before signing a long-term apartment lease, carefully reading the fine print is crucial. This seemingly tedious task can save you from significant headaches and unexpected expenses down the line.

The fine print often contains details that aren’t explicitly discussed during your apartment tour or initial conversations with the landlord or property manager. These details can include crucial information about fees, pet policies, lease renewal terms, late payment penalties, and responsibilities for repairs and maintenance.

Overlooking these details can lead to unexpected costs, disputes with your landlord, and even legal battles. For example, a seemingly small clause about responsibility for pest control could lead to significant expenses if you discover an infestation. Similarly, a hidden clause regarding lease renewal might lock you into unfavorable terms.

Take your time to thoroughly understand every aspect of the lease agreement. If anything is unclear, don’t hesitate to ask for clarification. It’s better to ask questions before signing than to regret it afterward. Having a clear understanding of the terms protects your rights and ensures a smoother tenancy.

In short, reading the fine print isn’t just about avoiding trouble; it’s about protecting your financial well-being and ensuring a positive experience in your new apartment. Don’t rush the process; take the time to read and understand everything before committing to a long-term lease.

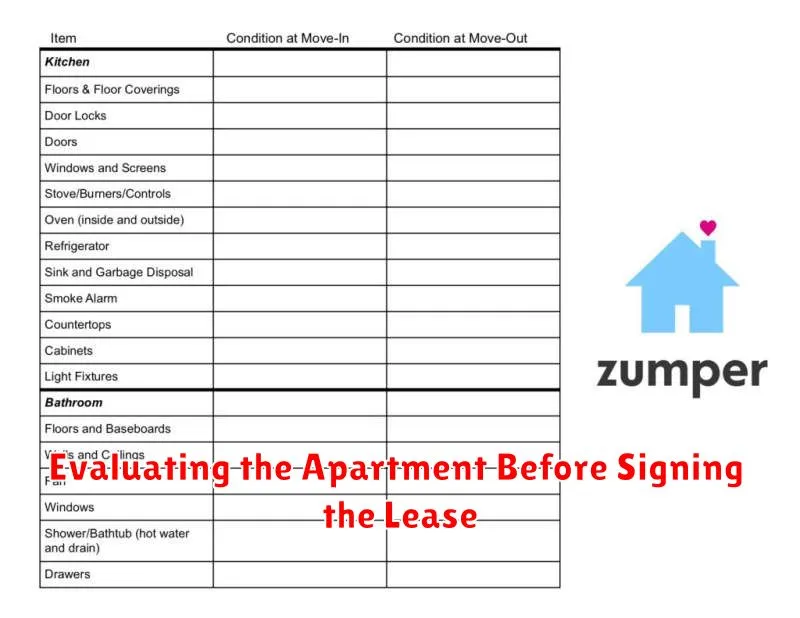

Evaluating the Apartment Before Signing the Lease

Before you sign that lease, take the time to thoroughly evaluate the apartment. This crucial step can save you from headaches and potential financial burdens down the line. Don’t rush the process; a careful inspection is paramount.

Inspect the condition of the unit: Pay close attention to details. Check for existing damages like cracks in walls, water stains on ceilings, or malfunctioning appliances. Document everything with photos or videos, and have the landlord acknowledge the pre-existing conditions in writing. This protects you from being held responsible for repairs later.

Test all appliances and fixtures: Ensure that the stove, oven, refrigerator, dishwasher, and other appliances work correctly. Turn on the lights, check the water pressure and temperature, and flush the toilets. Listen for any unusual noises from the plumbing or heating/cooling systems. A functioning unit is essential for comfortable living.

Assess the safety features: Confirm the presence and functionality of smoke detectors and carbon monoxide detectors. Check the locks on doors and windows to ensure they are secure. Consider the building’s security features if applicable (security cameras, gated access, etc.). Your safety and security are non-negotiable.

Consider the overall space and layout: Does the apartment meet your needs in terms of size, storage space, and layout? Ensure the closets are large enough, and that the overall flow of the apartment works for you. A well-thought-out inspection prevents future regrets.

Ask clarifying questions: Don’t hesitate to ask the landlord or property manager any questions you have about the apartment, the building, or the lease agreement itself. Clarifying any doubts before signing is critical. Remember, you are making a significant commitment.

By meticulously evaluating the apartment before signing the lease, you’ll safeguard your investment and ensure a comfortable living experience for the duration of your tenancy. A little extra time spent here will pay off immensely.

Rent Increases and How to Handle Them

Before signing a long-term apartment lease, it’s crucial to understand how rent increases work. Lease agreements often specify the terms regarding rent adjustments, usually including the frequency and maximum percentage of increase allowed.

Review your lease carefully to identify the clauses related to rent increases. Note the permitted percentage increase and whether there are any limitations or notice periods involved. Understanding these specifics allows you to budget accurately and avoid unexpected financial strain.

If your lease allows for annual rent increases, be prepared for them. Negotiating a lower starting rent can help offset potential future increases. Also, inquire about the landlord’s history with rent increases; this can provide valuable insight into potential future costs.

If a rent increase is proposed that you feel is excessive or violates your lease terms, don’t hesitate to communicate with your landlord. You have the right to understand the reasoning behind the increase and to potentially negotiate a more favorable arrangement. If negotiations fail, consider seeking legal advice.

Ultimately, understanding your lease agreement and the process for rent increases empowers you to make informed decisions and avoid unpleasant surprises during your tenancy. Careful planning and communication are key to a positive landlord-tenant relationship.

Conclusion: Making an Informed Decision for Long-Term Stays

Signing a long-term apartment lease is a significant commitment, so thorough research and careful consideration are paramount. This process shouldn’t be rushed. Before signing on the dotted line, ensure you’ve thoroughly investigated the property’s condition, understood all the terms and conditions of the lease, and are satisfied with the location, amenities, and surrounding neighborhood.

By diligently addressing all the points discussed in this article – from carefully reviewing the lease agreement and understanding your rights as a tenant, to checking the apartment’s condition and researching the neighborhood – you can confidently make an informed decision that will serve you well throughout your long-term stay. Remember, choosing the right apartment is crucial for your comfort, peace of mind, and overall well-being during your tenancy. Don’t hesitate to ask questions; a good landlord will be happy to assist you.

Ultimately, a successful long-term lease hinges on clear communication and a mutual understanding between you and your landlord. Take your time, weigh your options carefully, and you’ll be well-equipped to find the perfect apartment for your needs.