Planning a long-term stay in a boarding house? Knowing how to effectively budget is crucial for a stress-free and enjoyable experience. This comprehensive guide will walk you through creating a realistic budget for your long-term boarding house rental, covering everything from rent and utilities to unexpected costs and saving strategies. Learn how to manage your finances and avoid financial pitfalls so you can focus on making the most of your long-term boarding house accommodation. Let’s dive into the essentials of budgeting for long-term boarding house rentals!

Introduction: Planning Finances for Boarding Rentals

Securing a long-term boarding house rental requires careful financial planning. Unlike traditional rentals, boarding houses often involve additional costs and considerations. This guide will walk you through the essential steps to effectively budget for your stay, ensuring a smooth and stress-free experience.

Understanding your budget is paramount. This involves assessing your monthly income, identifying potential expenses, and setting realistic financial goals. Accurate calculations are crucial to avoid unexpected financial strain later on. We’ll cover specific areas such as rent, utilities, food, transportation, and personal expenses, helping you create a comprehensive budget.

Planning ahead will minimize financial surprises. Consider potential unexpected expenses, such as emergency repairs or medical bills. Building a financial cushion will provide security and peace of mind. We’ll explore practical strategies to help you save money and effectively manage your finances throughout your stay in the boarding house.

Estimating Monthly Rental Costs

Accurately estimating your monthly rental costs is crucial for budgeting a long-term boarding house stay. Start by getting a clear understanding of the base rent. This is usually the most significant expense. Don’t forget to factor in any utilities included in the rent; many boarding houses include some utilities while others charge extra for electricity, gas, water, and internet.

Next, consider any additional fees. Some boarding houses charge a security deposit, which is typically one or two months’ rent. You might also encounter cleaning fees, either at the beginning or end of your tenancy, or monthly maintenance fees. Parking fees are another common extra cost to keep in mind. Always clarify all these fees upfront to avoid surprises.

To get a precise estimate, add up the base rent, all included utilities, and any additional fees. It’s helpful to create a simple spreadsheet to organize these costs. This allows for a realistic picture of your total monthly expenditure. Remember to account for potential increases in utility costs, especially during peak seasons. Budgeting a little extra each month as a cushion for unexpected expenses is also good practice. This proactive approach ensures a smooth and financially stress-free long-term boarding house experience.

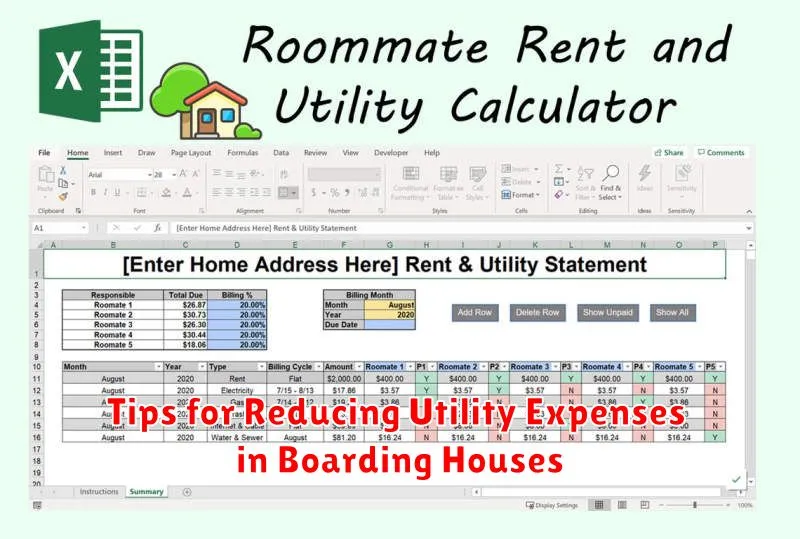

Tips for Reducing Utility Expenses in Boarding Houses

Living in a boarding house can be cost-effective, but utility expenses can quickly add up. Here are some simple tips to help you keep those costs down:

Conserve electricity: Turn off lights when leaving a room, unplug electronics when not in use (or use a power strip for easy on/off), and take advantage of natural light whenever possible. Consider energy-efficient light bulbs.

Reduce water usage: Take shorter showers, fix any leaky faucets promptly, and be mindful of water usage when doing dishes and laundry. Consider installing low-flow showerheads.

Limit heating and cooling: Adjust your thermostat strategically, using programmable settings to optimize temperatures when you’re away or asleep. Ensure windows and doors are properly sealed to prevent drafts.

Communicate with housemates: Open communication about utility usage and conservation efforts can significantly improve efficiency and reduce overall costs. Consider creating a shared responsibility system.

Understand your billing: Familiarize yourself with your utility bills to understand where your money is going. This allows you to pinpoint areas for improvement and track your progress in reducing consumption.

By implementing these simple energy-saving habits, you can significantly reduce your utility expenses and save money in the long run, making your boarding house experience more budget-friendly.

How to Share Costs with Roommates

Sharing a boarding house with roommates can significantly reduce your individual housing costs, but effective cost-sharing is crucial for a harmonious living experience. Transparency and clear communication are key from the start.

Before moving in, create a comprehensive budgeting plan outlining all shared expenses. This includes rent, utilities (electricity, water, gas, internet), and any other shared costs like cleaning supplies or household items. Discuss how these costs will be divided – equally, proportionally based on room size, or through some other agreed-upon method.

Consider using a shared online budgeting tool or spreadsheet to track expenses and payments. This promotes accountability and ensures everyone is aware of the financial contributions. Regularly review the budget to adjust for unexpected costs or changes in spending habits. A designated person can manage the finances, or you can rotate the responsibility to share the workload.

Establishing ground rules for shared resources is also important. Decide on how you’ll handle groceries, whether you’ll share meals, and how you’ll manage individual versus shared supplies. Clear expectations will prevent future misunderstandings and disagreements. Regularly communicate about expenses to ensure everyone is on the same page and address any concerns promptly.

Finally, remember that respectful communication is paramount. Openly discuss any financial concerns and work together to find solutions. By proactively managing shared costs, you can ensure a positive and financially manageable shared living experience.

Understanding Additional Fees in Boarding Rentals

When budgeting for a long-term boarding house rental, it’s crucial to account for additional fees beyond the base rent. These can significantly impact your overall costs, so understanding them is vital for accurate budgeting.

Utility fees are a common extra expense. While some boarding houses include utilities in the rent, many do not. Expect to pay separately for electricity, water, gas, and sometimes even internet or cable. Inquire about which utilities are included and the estimated monthly cost for those not included.

Cleaning fees are another potential cost. Some boarding houses charge a regular cleaning fee, either weekly or monthly, to maintain shared spaces. Others may require a one-time cleaning fee at the end of your tenancy.

Security deposits are almost always required. This is a sum held by the landlord as security against potential damage to the property. You should get this back at the end of your tenancy, provided the room is left in good condition. Ensure you understand the terms and conditions regarding the return of your security deposit.

Late fees can be substantial. Boarding houses often impose penalties for late rent payments. Be aware of the exact amount and due date to avoid unexpected charges.

Pet fees apply if you plan on bringing a pet. Many boarding houses either prohibit pets or charge extra fees for their presence. Confirm the pet policy and any associated costs beforehand.

Parking fees may also apply. If you need parking, determine whether parking is included or if there are additional fees for on-site or nearby parking.

Administrative fees are sometimes charged to cover administrative costs associated with your tenancy. Inquire about any such fees upfront.

Review your lease agreement carefully. This document will outline all fees, including any less common ones specific to the boarding house. Don’t hesitate to ask questions if anything is unclear. Accurate budgeting requires a complete understanding of all associated costs.

Saving Money with Long-Term Lease Agreements

One of the most significant ways to save money when budgeting for a long-term boarding house rental is by opting for a long-term lease agreement. Landlords often offer incentives for longer commitments, such as reduced monthly rent or waived fees.

Lower monthly rent is a major advantage. By committing to a longer lease (e.g., a year or more), you typically secure a lower rate than you would with a shorter-term agreement. This predictable, lower cost simplifies your budget and provides greater financial stability.

Beyond lower rent, some landlords might offer additional cost savings such as covering some or all of your utilities or offering a discount on other services. Always carefully review the lease agreement to understand the full scope of any such offers.

The predictability offered by a long-term lease is invaluable for budgeting. Knowing your exact housing costs for an extended period removes a significant variable from your monthly expenses, allowing for more accurate financial planning.

However, remember to weigh the advantages against potential drawbacks. A longer lease reduces your flexibility. Before signing, ensure you’re comfortable with the commitment period and the terms outlined in the lease agreement. Careful consideration of these factors will help you determine if a long-term lease is the best financial choice for your specific circumstances.

The Role of Location in Rental Pricing

Location is a major factor influencing boarding house rental prices. Areas with high demand, such as those close to city centers, universities, or popular attractions, typically command higher rental rates. This is due to increased convenience and accessibility.

Conversely, locations further from the city center or with less desirable amenities often have lower rental costs. Factors like proximity to public transportation, the safety of the neighborhood, and the availability of local amenities (shops, restaurants, etc.) also play a significant role in determining price.

Before committing to a rental, carefully research the area. Consider commuting times, access to essential services, and the overall safety and desirability of the neighborhood. This research will help you assess whether the asking price is reasonable for the location and amenities provided. Understanding the impact of location on pricing is crucial for creating a realistic budget for your long-term boarding house rental.

Conclusion: Staying on Budget with Boarding Rentals

Finding affordable long-term boarding house rentals is achievable with careful planning. By prioritizing needs over wants, negotiating rental rates, and tracking expenses meticulously, you can significantly reduce your overall housing costs. Remember to factor in hidden costs like utilities and transportation to create a truly realistic budget.

Careful budgeting isn’t just about saving money; it’s about gaining control over your finances and ensuring your long-term financial stability. With a well-defined plan and a commitment to sticking to it, you can enjoy comfortable and affordable boarding house living. Don’t be afraid to seek advice from financial advisors or experienced renters to further refine your approach.

Ultimately, successful long-term boarding house budgeting is a process of continuous evaluation and adjustment. Regularly review your spending habits, identify areas for improvement, and adapt your budget as needed. With consistent effort, you can achieve your financial goals and enjoy peace of mind knowing you’re making smart choices about your housing.